Estimating your taxes for 2024 can be straightforward with the right approach. This step-by-step guide will assist you in accurately calculating your estimated taxes and avoiding potential underpayment penalties.

Step 1: Understand Your Effective Tax Rate

First, let’s define the effective tax rate. You might be familiar with the tax brackets the IRS updates annually. These brackets represent marginal tax rates, which tell you how much tax you need to pay on an additional dollar of income. However, the effective tax rate, also known as the average tax rate, gives you a better idea of how much tax you pay on average across all your income.

The effective tax rate is calculated by dividing the total taxes paid by your total taxable income. This rate is helpful for planning and estimating the amount of taxes you need to withhold from your paycheck or pay through quarterly estimated taxes.

Step 2: Identify Your Filing Status

There are four types of filing statuses:

- Single

- Head of Household

- Married Filing Jointly

- Married Filing Separately

Each status has its own tax bracket schedule, which can be confusing when calculating your taxes. Here’s an easy way to estimate your effective tax rate based on your previous tax return.

Step 3: Calculate Your Effective Tax Rate

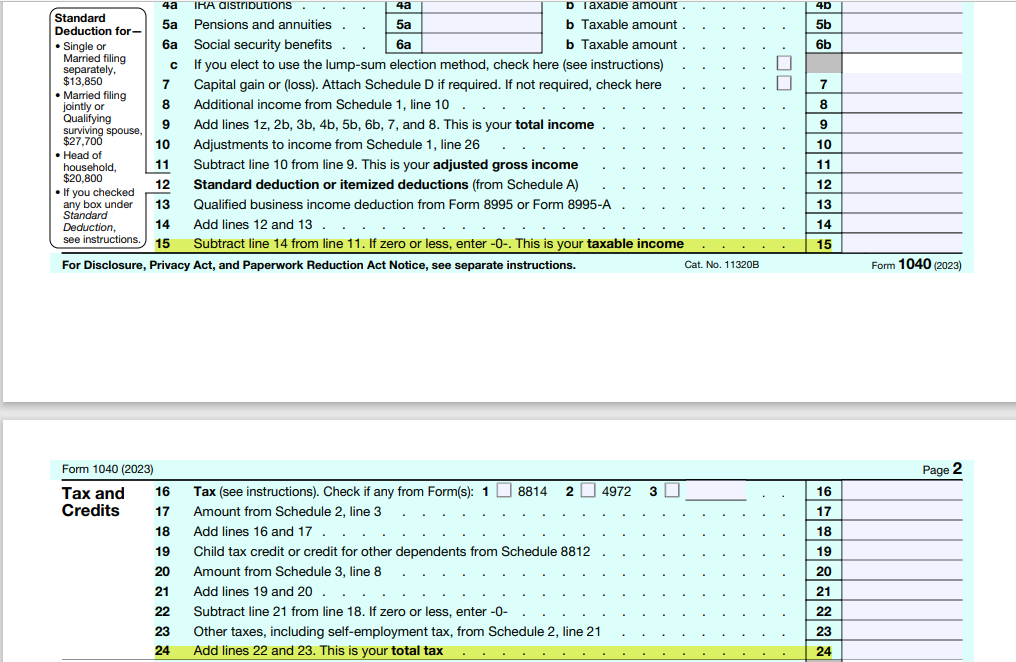

- Find your 2023 tax return.

- Locate the amount on Line 24 (total tax).

- Divide this amount by the number on Line 15 (taxable income).

The result is your effective tax rate for 2023. If your income hasn’t increased dramatically, you can use this rate to estimate your taxes for 2024.

Step 4: Estimate Your 2024 Taxes

Multiply your estimated total income for 2024 by your effective tax rate. To avoid an underpayment penalty on tax form 2210, you need to withhold at least 90% of your current year’s projected taxes, either through paycheck withholding or by making quarterly payments on the IRS website. Alternatively, you can withhold the total amount from Line 24 of your 2023 tax return, which is 100% of your previous year’s taxes. However, if your income exceeds $75,000 for single filers or $150,000 for married filers, you need to use 110% of the amount on Line 24.

Example Calculation

Let’s go through an example:

- John is married and files jointly.

- In 2023, his taxable income (Line 15) was $160,000.

- The total tax he paid (Line 24) was $25,000.

To find his effective tax rate:

Effective Tax Rate = Total Tax / Taxable Income = 25,000 / 160,000 = 16%

John estimates his 2024 income to be $200,000. Using his effective tax rate:

Estimated Tax = 200,000 × 16% = 32,000

To avoid underpayment penalties, John needs to withhold at least 90% of this amount:

32,000 × 90%= 28,800

However, since his income exceeds $150,000, he can also base his withholding on 110% of his 2023 taxes:

25,000 × 1.1 = 27,500

Comparing the two amounts, $27,500 is less than $28,800. Therefore, John can use $27,500 as his estimated tax amount for 2024 to avoid underpayment penalties.

By following these steps, you can easily estimate your taxes for 2024 and ensure you withhold the correct amount to avoid penalties. Happy tax planning!