What is the Cash Conversion Cycle (CCC)?

The Cash Conversion Cycle measures the time it takes to turn your inventory into cash from sales. It consists of three components:

- Days Inventory Outstanding (DIO): The average number of days you hold inventory before selling it.

- Days Sales Outstanding (DSO): The average number of days it takes to collect payment after a sale.

- Days Payable Outstanding (DPO): The average number of days you take to pay your suppliers.

The formula for CCC is:

CCC = DIO + DSO − DPO

To understand CCC better, let’s look at some data from well-known companies in retail industry (source: https://finbox.com).

Walmart’s cash conversion cycle for fiscal years ending January 2020 to 2024 averaged 4 days. Costco Wholesale’s cash conversion cycle for fiscal years ending September 2019 to 2023 averaged 1 day. That said, it generally only took a few days for these retail giants to receive cash after selling their inventories.

Amazon averaged an incredible -38 days of CCC for fiscal years ending Dec 2019 to 2023. Amazon’s negative CCC means they receive money from customers before having to pay their suppliers. Essentially, Amazon has cash on hand for up to 30 days before paying for the products sold. This provides Amazon with significant cash flow advantages. It’s important to note that this CCC calculation considers Amazon as a merchant directly selling products to customers, not as a marketplace facilitating sales for 3rd-party sellers.

Your Position on TikTok Shop

For TikTok Shop, let’s see where you stand. TikTok Shop has two main operating models: Warehouse and Dropshipping.

- Warehouse Model: You prepurchase and stock inventory upfront it in your warehouse.

- Dropshipping Model: You don’t store inventory. When you make a sale, you place an order with your supplier, who then ships the product directly to the customer.

Let’s focus on the dropshipping model as this is by far the easiest, leanest, and most popular way to sell on TikTok Shop. Imagine you sell iPhone cases. Customer A places an order for a $10 case plus $3 shipping, so you are anticipating $13 in total. You then place an order with your suppliers for iPhone cases at a cost of $5, plus the $3 shipping.

- DIO: on TikTok the regular days for inventory to be shipped to customers are within 14 days, so DIO is 14 days.

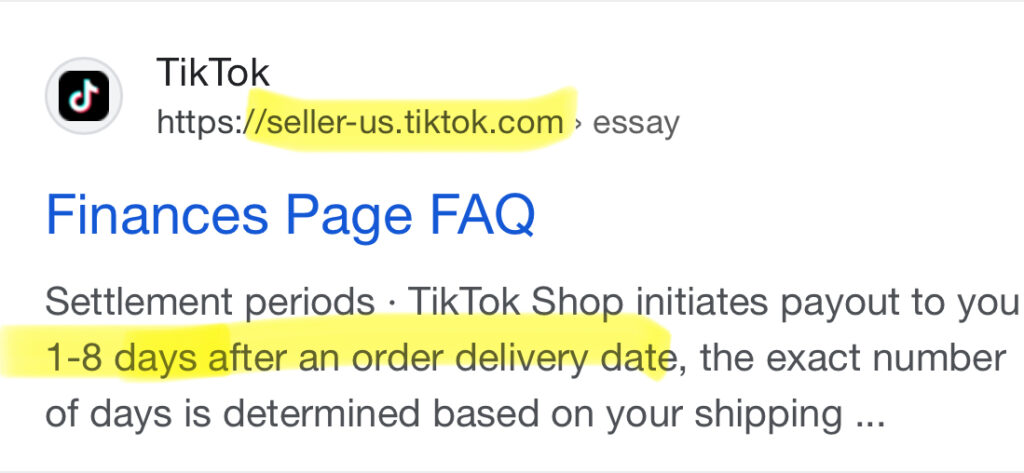

- DSO: It takes up to one week for TikTok to deposit the cash into your account. This is 7 days.

- DPO: You pay your suppliers immediately when you place the order. Therefore, this is 0 day.

So, your CCC for dropshipping is:

CCC = 14 + 7 − 0 = 21 days

Therefore, even with the leanest dropshipping model, this 21-day gap is still where you may face a cash flow dilemma. You would have to pay $8 ($5 case + $3 shipping) per item to your supplier out of your pocket first before receiving the $13 21 days later. Image how much cash you have to have on hand if a few of your TikTok videos promoting the item went viral, generating thousands of sales in a short period of time.

Increased sales mean higher operational costs and the need for more cash upfront to pay suppliers, which can drain your cash reserves.

Understanding and managing the Cash Conversion Cycle is crucial for maintaining healthy cash flow in your TikTok Shop business. By knowing your CCC and its components, you can take proactive steps to strategically select the suppliers to partner with and optimize your sales force accordingly.